The Black Swan is the 2nd book in the five-book series by Nassim Nicholas Taleb on uncertainty. In this book, he explains the phenomenon of Black Swans, i.e. extremely unpredictable events that have a massive impact on our societies and the course of history. In this free version of The Black Swan summary, we’ll outline some of the key ideas in the book, including how we’re surrounded by randomness beyond our control, why we struggle to accept it, and how we can address our blind spots.

What is the book The Black Swan About?

What are Black Swans and why are they important?

For thousands of years, it was widely believed that all swans were white. Then in 1697, a Dutch explorer Willem de Vlamingh discovered black swans in Australia, debunking this universal “truth” overnight. The term “Black Swan” has since been used to describe the occurrence of a seemingly-impossible event.

3 key features of Black Swans

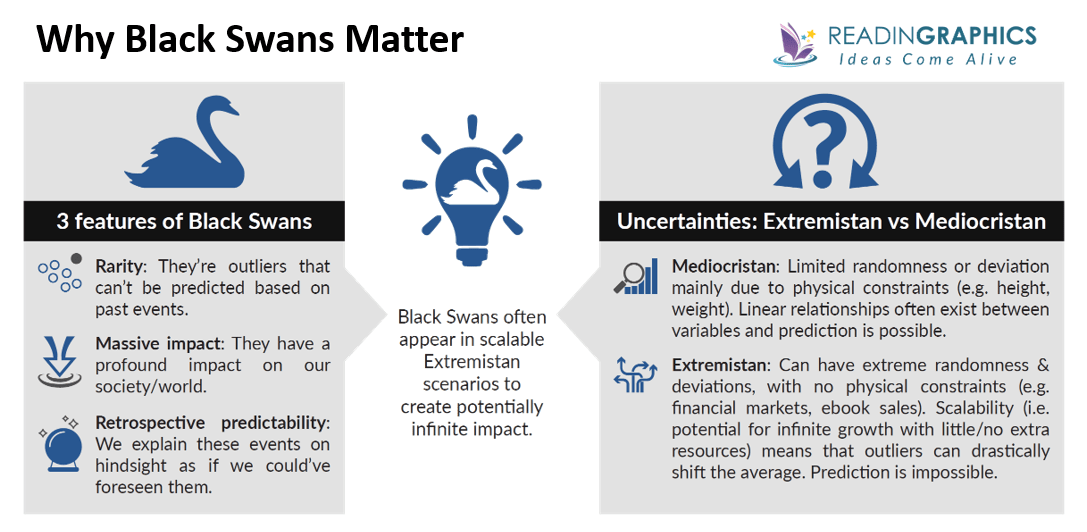

Nassim Taleb identifies 3 key features of Black Swans:

- Rarity: Black Swans are outliers that can’t be reasonably expected to happen based on past events.

- They have a profound impact on our society/world.

- Retrospective predictability: Although the events are unpredictable, humans tend to explain them on hindsight as if they could be perfectly understood and predicted.

Black Swans are not inconsequential anomalies, but a significant phenomenon that shapes the very world we live in. Many historical events that drastically impacted our societies and lives were actually Black Swan events. These include the 2 world wars, the fall of the Berlin Wall, the 11 Sep 2001 terrorist attacks, the rise of the Internet, the 1987 stock-market crash, the 2008 financial crisis and the 2019 Covid pandemic. In all of these cases, no one could’ve predicted the events in advance (no matter what we claim afterward), nor could we have foreseen their sweeping effects.

Many of the major turning points in your personal life (e.g. how you met your spouse, your biggest gains and losses) were also likely to have been unexpected, i.e. they didn’t come from standard events on your daily schedule.

2 Types of Uncertainty: Extremistan vs. Mediocristan

Differences between Extremistan vs. Mediocristan

Nassim Nicholas Taleb differentiates between 2 types of uncertainties:

- In Mediocristan environments, there’s a limit to the amount of randomness or deviation from the average. Inequalities exist, but they’re mild or controlled. Usually, there’re some physical constraints (e.g. height, weight, running speed) which limit the amount of variability. For example, if you add the tallest or heaviest man in history to a sample size of 1,000 people, the outlier won’t make a real difference to the average. There’s also typically a linear relationship between variables. Prediction is possible in such environments or systems.

- In Extremistan environments, there can be wild randomness and extreme deviations. Typically, there’re no physical constraints and no known upper/lower limits (e.g. knowledge, financial markets, e-book sales, social media “likes”). Thus, the outliers can make a big difference—if you add the net worth of Jeff Bezos or Bill Gates to a group of 1,000 people, it will drastically shift the average.

Scalability

A key difference between Mediocristan and Extremistan is the scalability. Something is scalable if it can grow exponentially with little/no additional resources. A massage therapist is a non-scalable profession since he/she can only serve so many clients in a day. However, a singer in the digital age is a scalable profession since he/she can perform a song once, record and disseminate it widely. Scalability can create vast inequalities, extremities and winner-takes-all situations. Top singers earn vastly more than average singers, even though they aren’t proportionately more talented.

Black Swans are so disruptive partially because they often appear in scalable Extremistan scenarios. A single unexpected event can flip everything on its head with potentially infinite impact. You can’t lose much weight in 1 day (Mediocristan), but you can lose all your money in an instant (Extremistan).

Overcoming our Blindness to Black Swans

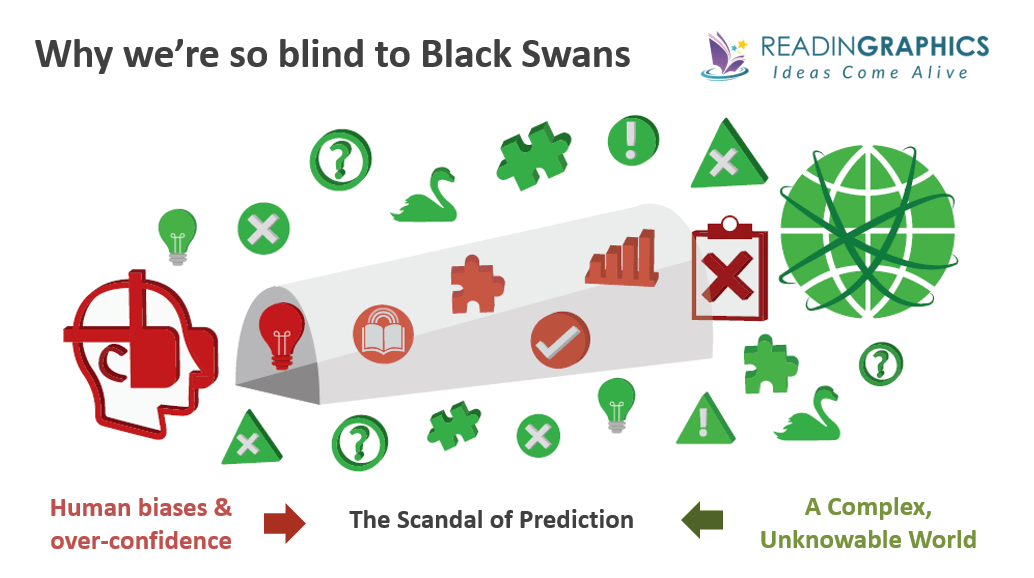

Black Swans are the “unknown unknowns” which can’t be accounted for, even by the most sophisticated models. Yet, we tend to pretend that Black Swans don’t exist. Our cognitive biases make us focus on what little we can see/grasp, deluding ourselves that we know exactly what’s happening. In reality, what we know is merely a single observation of the vast amount of things that we don’t know.

Here’s a brief overview of why our world is inherently unpredictable and why our human mental biases lead us to be over-confident of our predictions and conclusions. Do get a copy of the complete version of The Black Swan summary for more details.

Human Biases and Tunneling

In the book, Nassim Nicholas Taleb explains why the human brain is so susceptible to misconceptions and overconfidence, and what we can do about it. In our complete 15-page summary, you can get more details and examples on:

- The confirmation bias and the round-trip fallacy, including how we confuse an absence of evidence with an evidence of absence, and the difference between negative empiricism vs naive empiricism.

- What’s the narrative fallacy and how to overcome it

- Why we’re blind to nonlinearities and the implications

- Why empirical evidence is flawed due to silent evidence and why we’re prone to the survivor bias

Difficulties of Prediction

Ultimately, our world and future are unknowable and unpredictable because of various factors, including:

- The role of chance and luck in inventions and game-changing discoveries

- The inherently unpredictable nature of dynamical systems and variables that behave in inconsistent or nonlinear ways

- We can’t make accurate predictions with flawed and incomplete information.

Do check out the full version of The Black Swan summary for to zoom in on each of these factors.

The Scandal of Prediction and Epistemic Arrogance

The combination of the 2 sets of factors above means that: humans are terrible at prediction, yet we keep making predictions without realizing how frequently we’re off the mark. Taleb calls this the “scandal of prediction”.

In our full 15-page summary, we’ll explain:

- What’s epistemic arrogance and its implications;

- Why we should beware of experts’ predictions (and our own predictions);

- Why the past is even harder to predict than the future; and

- How to stop being suckers and start becoming smarter about the way we see the world.

Coping in a World of Uncertainty

If we’re surrounded by randomness and cannot plan ahead with certainty, is there anything we can do? In our complete version of The Black Swan summary, we’ll explain how you can leverage the inherent asymmetry of Extremistan environments to maximize your upsides for positive Black Swans while minimizing the downsides for negative Black Swans.

Getting the Most from The Black Swan

In this article, we’ve briefly outlined some of the key insights and strategies you can use to achieve desired change. For more examples, details, and actionable tips to apply these strategies, do get our complete book summary bundle which includes an infographic, 15-page text summary, and a 26-minute audio summary.

In this book, Nassim Nicholas Taleb uses numerous examples and research studies to explain the Black Swan phenomenon and the fallacy of human predictions. Besides the key ideas captured in our summary, the book also includes detailed comparisons between Mediocristan and Extremistan environments, with several additional chapters to discuss the technicalities of concepts such as bell-curves, deviations, inequalities, randomness, fractality etc. You can purchase the book here for the full details, or check out www.fooledbyrandomness.com.

[To learn more about ethics and asymmetry in an uncertain world, do check out our Skin in the Game summary!]Who should read this:

• Leaders (in profit, nonprofit, and public sectors), educators and analysts.

• Anyone wants to expand their perspective and learn how the world truly works.

The Black Swan Chapters

See All Chapters (Click to expand)

Our summaries are reworded and reorganized for clarity and conciseness. Here’s the full chapter listing from The Black Swan by Nassim Nicholas Taleb, to give an overview of the original content structure in the book.

Prologue

On the Plumage of Birds

What You Do Not Know

Experts and “Empty Suits”

Learning to Learn

A New Kind of Ingratitude

Life Is Very Unusual

Plato and the Nerd

Too Dull to Write About

The Bottom Line

Chapters Map

PART ONE: Umberto Eco’s Antilibrary, or How We Seek Validation

Chapter 1: The Apprenticeship of an Empirical Skeptic

– Anatomy of a Black Swan

– On Walking Walks

– “Paradise” Evaporated

– The Starred Night

– History and the Triplet of Opacity

– Nobody Knows What’s Going On

– History Does Not Crawl, It Jumps

– Dear Diary: On History Running Backward

– Education in a Taxicab

– Clusters

– Where Is the Show?

– 83/4 Lbs Later

– The Four-Letter Word of Independence

– Limousine Philosopher

Chapter 2: Yevgenia’s Black Swan

Chapter 3: The Speculator and the Prostitute

– The Best (Worst) Advice

– Beware the Scalable

– The Advent of Scalability

– Scalability and Globalization

– Travels Inside Mediocristan

– The Strange Country of Extremistan

– Extremistan and Knowledge

– Wild and Mild

– The Tyranny of the Accident

Chapter 4: One Thousand and One Days, or How Not to Be a Sucker

– How to Learn from the Turkey

– Trained to Be Dull

– A Black Swan Is Relative to Knowledge

– A Brief History of the Black Swan Problem

– Sextus the (Alas) Empirical

– Algazel

– The Skeptic, Friend of Religion

– I Don’t Want to Be a Turkey

– They Want to Live in Mediocristan

Chapter 5: Confirmation Shmonfirmation!

– Zoogles Are Not All Boogies

– Evidence

– Negative Empiricism

– Counting to Three

– Saw Another Red Mini!

– Not Everything Back to Mediocristan

Chapter 6: The Narrative Fallacy

– On the Causes of My Rejection of Causes

– Splitting Brains

– A Little More Dopamine

– Andrey Nikolayevich’s Rule

– A Better Way to Die

– Remembrance of Things Not Quite Past

– The Madman’s Narrative

– Narrative and Therapy

– To Be Wrong with Infinite Precision

– Dispassionate Science

– The Sensational and the Black Swan

– Black Swan Blindness

– The Pull of the Sensational

– The Shortcuts

– Beware the Brain

– How to Avert the Narrative Fallacy

Chapter 7: Living in the Antechamber of Hope

– Peer Cruelty

– Where the Relevant Is the Sensational

– Nonlinearities

– Process over Results

– Human Nature, Happiness, and Lumpy Rewards

– The Antechamber of Hope

– Inebriated by Hope

– The Sweet Trap of Anticipation

– When You Need the Bastiani Fortress

– El desierto de los tártaros

– Bleed or Blowup

Chapter 8: Giacomo Casanova’s Unfailing Luck: The Problem of Silent Evidence

– The Story of the Drowned Worshippers

– The Cemetery of Letters

– How to Become a Millionaire in Ten Steps

– A Health Club for Rats

– Vicious Bias

– More Hidden Applications

– The Evolution of the Swimmer’s Body

– What You See and What You Don’t See

– Doctors

– The Teflon-style Protection of Giacomo Casanova

– “I Am a Risk Taker”

– I Am a Black Swan: The Anthropic Bias

– The Cosmetic Because

Chapter 9: The Ludic Fallacy, or The Uncertainty of the Nerd

– Fat Tony

– Non-Brooklyn John

– Lunch at Lake Como

– The Uncertainty of the Nerd

– Gambling with the Wrong Dice

– Wrapping Up Part One

– The Cosmetic Rises to the Surface

– Distance from Primates

PART TWO: We Just Can’t Predict

From Yogi Berra to Henri Poincaré

Chapter 10: The Scandal of Prediction

– On the Vagueness of Catherine’s Lover

– Count Black Swan Blindness Redux

– Guessing and Predicting

– Information Is Bad for Knowledge

– The Expert Problem, or the Tragedy of the Empty Suit

– What Moves and What Does Not Move

– How to Have the Last Laugh

– Events Are Outlandish

– Herding Like Cattle

– I Was “Almost” Right

– Reality? What For?

– “Other Than That,” It Was Okay

– The Beauty of Technology: Excel Spreadsheets

– The Character of Prediction Errors

– Don’t Cross a River if It Is (on Average) Four Feet Deep

– Get Another Job

– At JFK

Chapter 11: How to Look for Bird Poop

– Inadvertent Discoveries

– A Solution Waiting for a Problem

– Keep Searching

– How to Predict Your Predictions!

– The Nth Billiard Ball

– Third Republic-Style Decorum

– The Three Body Problem

– They Still Ignore Hayek

– How Not to Be a Nerd

– Academic Libertarianism

– Prediction and Free Will

– The Grueness of Emerald

– That Great Anticipation Machine

Chapter 12: Epistemocracy, a Dream

– Monsieur de Montaigne, Epistemocrat

– Epistemocracy

– The Past’s Past, and the Past’s Future

– Prediction, Misprediction, and Happiness

– Helenus and the Reverse Prophecies

– The Melting Ice Cube

– Once Again, Incomplete Information

– What They Call Knowledge

Chapter 13: Apelles the Painter, or What Do You Do if You Cannot Predict?

– Advice Is Cheap, Very Cheap

– Being a Fool in the Right Places

– Be Prepared

– The Idea of Positive Accident

– Volatility and Risk of Black Swan

– Barbell Strategy

– “Nobody Knows Anything”

– The Great Asymmetry

PART THREE: Those Gray Swans of Extremistan

Chapter 14: From Mediocristan to Extremistan, and Back

– The World Is Unfair

– The Matthew Effect

– Lingua Franca

– Ideas and Contagions

– Nobody Is Safe in Extremistan

– A Brooklyn Frenchman

– The Long Tail

– Naïve Globalization

– Reversals Away from Extremistan

Chapter 15: The Bell Curve, That Great Intellectual Fraud

– The Gaussian and the Mandelbrotian

– The Increase in the Decrease

– The Mandelbrotian

– What to Remember

– Inequality

– Extremistan and the 80/20 Rule

– Grass and Trees

– How Coffee Drinking Can Be Safe

– Love of Certainties

– How to Cause Catastrophes

– Quételet’s Average Monster

– Golden Mediocrity

– God’s Error

– Poincaré to the Rescue

– Eliminating Unfair Influence

– “The Greeks Would Have Deified It”

– “Yes/No” Only Please

– A (Literary) Thought Experiment on Where the Bell Curve Comes From

– Those Comforting Assumptions

– “The Ubiquity of the Gaussian”

Chapter 16: The Aesthetics of Randomness

– The Poet of Randomness

– The Platonicity of Triangles

– The Geometry of Nature

– Fractality

– A Visual Approach to Extremistan/Mediocristan

– Pearls to Swine

– The Logic of Fractal Randomness (with a Warning)

– The Problem of the Upper Bound

– Beware the Precision

– The Water Puddle Revisited

– From Representation to Reality

– Once Again, Beware the Forecasters

– Once Again, a Happy Solution

– Where Is the Gray Swan?

Chapter 17: Locke’s Madmen, or Bell Curves in the Wrong Places

– Only Fifty Years

– The Clerks’ Betrayal

– Anyone Can Become President

– More Horror

– Confirmation

– It Was Just a Black Swan

– How to “Prove” Things

Chapter 18: The Uncertainty of the Phony

– Ludic Fallacy Redux

– Find the Phony

– Can Philosophers Be Dangerous to Society?

– The Problem of Practice

– How Many Wittgensteins Can Dance on the Head of a Pin?

– Where Is Popper When You Need Him?

– The Bishop and the Analyst

– Easier Than You Think: The Problem of Decision Under Skepticism

Chapter 19: Half and Half, or How to Get Even with the Black Swan

– When Missing a Train Is Painless

– The End

Epilogue: Yevgenia’s White Swans

About the Author of The Black Swan

The Black Swan : The Impact of the Highly Improbable is written by Nassim Nicholas Taleb–a Lebanese-American writer, scholar and mathematical statistician, best known for his work on randomness, probability, and uncertainty. He received his bachelor and master of science degrees from the University of Paris. He holds an MBA from the Wharton School at the University of Pennsylvania, and a PhD in Management Science from the University of Paris. Taleb was a former option trader and risk analyst at various trading and financial firms. He has been a professor at several universities, and has been co-editor-in-chief of the academic journal Risk and Decision Analysis since September 2014. He has also been a practitioner of mathematical finance, a hedge fund manager, and a derivatives trader, and is currently listed as a scientific adviser at Universa Investments.

The Black Swan Quotes

“What we see is not necessarily all that is there.”

“We see the obvious and visible consequences, not the invisible and less obvious ones. Yet those unseen consequences… generally are…more meaningful.”

“Governments are great at telling you what they did, but not what they did not do.”

“Our ideas are sticky: once we produce a theory, we are not likely to change our minds.”

“We attribute our successes to our skills, and our failures to external events outside our control.”

“We have a natural tendency to listen to the expert, even in fields where there may be no experts.”

“If you believe in free will you can’t truly believe in social science and economic projection. You cannot predict how people will act.”